2020 week1 model portfolio update

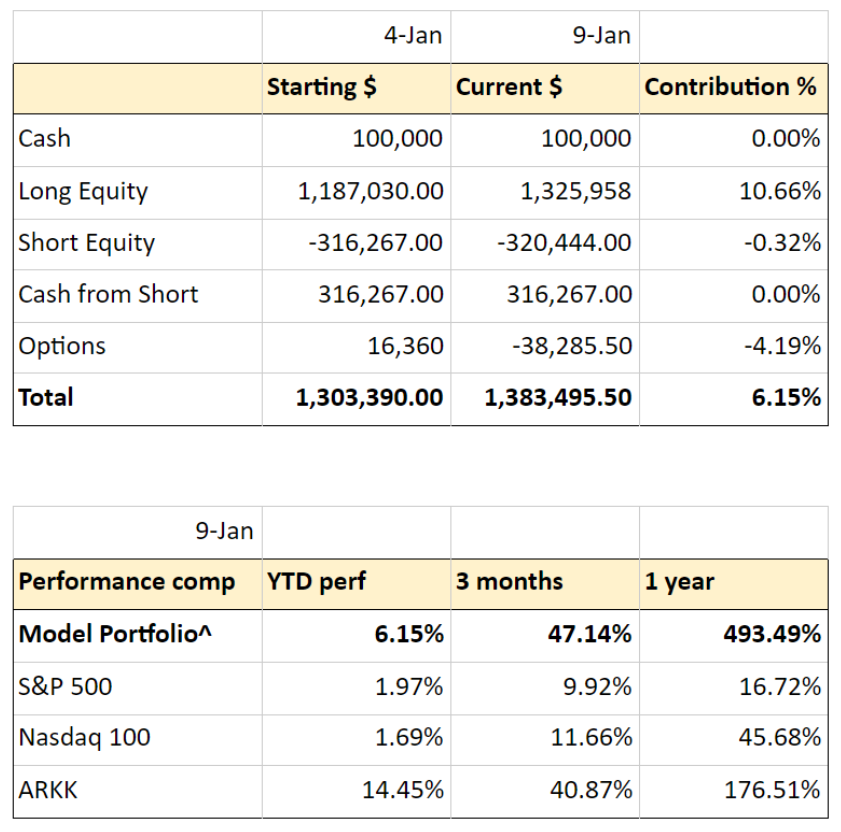

Overall performance:

2021 starts with an exceptionally strong week, especially for some of momentum names.

Our model portfolio benefited from its long equity sector which added 10.66%, including very strong performance from $BILI $TSLA $CRSP. We think their valuations start to look expensive even assuming very strong execution from the operators. Momentum might continue but diligent investors should start to seek some protections.

The option strategies have detracted 4.19% from the total performance, mainly due the risk-reversal overlay for some of the more volatile names. We intend to keep them given sharp corrections have proven to be not rare in those names, and a little patience and realistic expectations won’t hurt.

Over 3 months and 12 months period, the strategy proves its ability to show resilience and to enjoy upside growth.

^ 3 months and 1 year numbers are from actual portfolio. Email us hey@deepyield.io if you want more details.

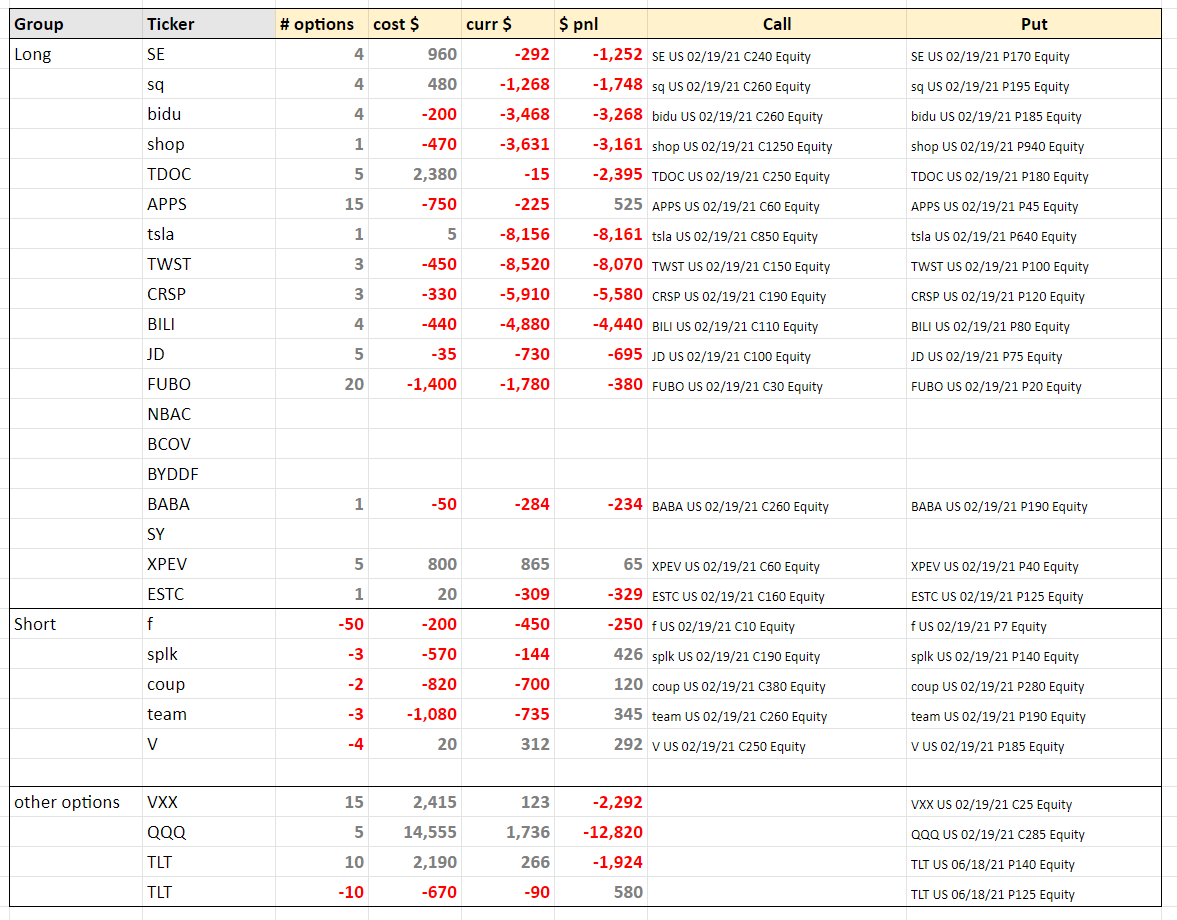

Full holdings of our model portfolio:

We primarily long names that we believe can generate and sustain strong growth and are able to produce stronger than expected cash flows and earnings. The portfolio weight is based on companies' future valuation ranking. We also short some of the most expensive names in relevant sectors as a protection.

Option overlay details:

For some of our Long & Short Equities, we use risk-reversal or the inverse to protect the underlying risk. We believe the current option market has been showing some inefficiency, or at least discrepancies to our expectation of the names; most of the option overlay can be self-funded by giving up some extreme upside within a short period of time.

We also implement other option overlay to hedge unexpected risk-off scenarios. We think a decent growth portfolio can take these costs and our quantitative model has been seeking the most efficient hedge continuously.

Disclosure: do you own work before put a cent in this crazy market. Our model portfolio is for education and hopefully entertainment purpose only.