Growth and Bonds

protect your growth stocks with a trade ~8x max payoff in 6 months.

On the internet, opinions are cheap; show me the trade ideas.

We are trying to democratize the knowledge of investment & portfolio management, by bringing institutional quality trade ideas to retail investors.

Our service includes a weekly newsletter for trade ideas, and a model portfolio you can track.

We believe transparent and affordable investment service is the future.

Optimism bias

2020 has been a year when every computer science college student becomes a growth investor and the kid from the neighbourhood generates 700% return from $TSLA. It has also been a year that almost 1/3 of youtube videos on my timeline have been talking about ARK top holdings and analyzing their daily transactions.

For average retail investor, the optimism bias has likely reached all time high. Such optimism bias usually develops over three levels:

overestimate of positive things (more stimulus bill, better-than-expected earnings, believe 10% daily return can repeat) and under-estimate of negative events (slower growth, bad earnings, believe all sell-offs is temporary and will bounce back )

generate positive expectations again and again

optimism about self but pessimistic about others. (think yourself would be the one of the very few who can sell at top or before the next crisis.)

How do we not let such optimism bias overtake our rationality and what kind of portfolio protection should we be seeking at this stage.

The key is trying to understand the fundamental driver of the current round of asset price appreciation via first-principles thinking and reverse-engineering what might cause the next meltdown, even though most of our investing/trading failure is the failure to imagine the next crisis.

Almost too good to be true

QE and ZIRP (zero interest rate policy) is the elephant in the room. Yet I think most people have massively underestimated how well the "long government bond" strategy has performed historically.

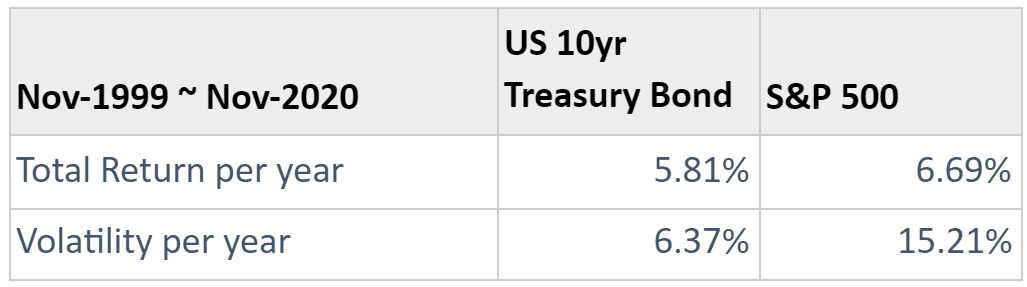

Since Nov-1999 to Nov-2020, over the 21-year period containing 3 major market crashes, US ten year government bonds has generated an annualized total return of 5.8%, compared to 6.7% from S&P 500 total return (including dividends) ; the <1% underperformance is more than well compensated by the materially lower volatility (annualized 6.4% for 10yr Bond vs. 15.2% for S&P500).

This two-decade bull run of the Government bonds is not only just as strong as the equity market (even better adjusted for volatility); it amazingly provides an inherently negatively correlated capital protection to most temporary equity weakness.

Over the same 21-year period, there've been 52 months where S&P500 had lost more than 2%; US government bonds had generated a positive number over 40 months out of those 52 months, thanks to flight-to-quality & flight-to-liquidity investor reactions.

This arguably is the best supporting player you can ask for your portfolio: giving you green numbers when everything else is red; yet returning you just as much over the long term. It almost sounds too good to be true; It's like getting paid to have insurance. Continuously buying equity puts to provide similar protection would cost a fortune over the long run.

Such “self-yielding” insurance policy lays the foundation for traditional 60-40 or risk-parity portfolio construction. And that foundation started to disappear as the yields started to disappear. Two reasons:

coupons are still a major component for the total return of holding government bonds; again over the same 21 years, even with unrepeatable price appreciation (yield decreasing) from the US Government bonds, coupons have contributed 57% or 3.3% out of the 5.8% total return per year.

such low yields means there're (very) limited room left for the yields to compress further from this point = there's limited room for "long-bond" to provide capital appreciation into next equity weakness.

Losing insurance = taking more risk?

Ironically most institutional investors never trimmed back their risk taking when their insurance from longing bonds became less effective. This might seem absurd but is totally logical if you think from first-principles:

less yields usually = less expected return from the Bond location. That means if your portfolio target return hasn't changed (e.g. 9% per year) you need to source that return from your equity or other risky allocations. Investors might choose defensive equity names for this particular bucket, it is however still equity risk and will increase the overall beta of the portfolio.

Some investors view coupons as an income is less important for holding bonds. Given bond yield can go negative, it is possible that a 10-year-US-treasury's Yield to Maturity (YTM) can move from +0.95% to -0.50%, and generate well over 10% capital gain via the bond price going up. (the sensitivity between YTM and the price change is measured by duration and convexity). It is not the most probable scenario, but simply having such possibility could mean investors are not afraid of taking the same risks.

opportunity cost is much less; this just encourages more risk taking and it has a domino effect: the government bond guys got squeezed by FED and chase more yields into corporate bonds; the corporate bond guys got squeezed out and chase more yields into junk bonds ... the value equity guys chase growth, the growth guys chase small cap growth, the small cap growth chases small cap biotech...and so on so forth.

most importantly, valuation (at least in theory).

How to discount Netflix monthly subscription fees?

The basic of stock valuation is discounting future cash flows.

For a construction company, one supposedly discounts the expected revenues for its signed contracts over the next 3 years; But how do you discount Netflix's future revenues; how do you discount basically the entire Nasdaq 100 index when everyone is turning into monthly subscription model.

A high quality growth business usually has the stickiness and continuity of its monthly recurring revenue. It smooths out the lumpy upfront cash flow over a much longer time horizon, meaning investors need to look further when deriving all the future income, and start to take into account not only the 12 month cash rate, but 5-year, 10-year and/or 20-year treasury yields.

This simply makes investing in $MSFT $AMZN and most SaaS companies, to some extent, an amplified long duration trade; meaning the price of these equities would behave in a similar way to the price of a long term treasury bond in reaction to long term interest rate, holding all else unchanged/equal.

Take an actual US 30 year bond T 2.5% Aug-2049 (it pays 2.5% coupon a year till Aug-49) as an example, when its yield (an indicator of the discount rate of the cash flow 30 years from now) dropped from 2.3% to 1% earlier 2020, the bond price increased over 30% from $97 to $131. Equities as a matter of fact can/should be viewed as a long term bond where its earnings acts like bond coupons. GMO has a nice article about this and they call it "The Duration Connection".

FED can lower the overnight interest rate and set expectations for short term rates, the long term rates however is almost definitely a function of market expectation and an outcome of market activities. A sharp flattening of the yield curve (especially the long end) could beautifully help the valuation of companies (espeically ones with long recurring cash flow), and quite the opposite should the steepening happens.

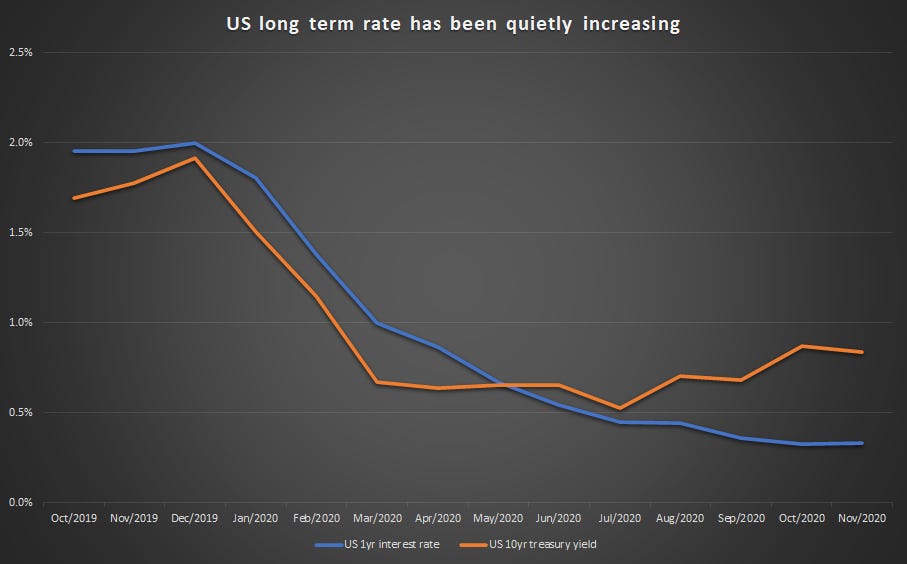

And the steepening is happening, quietly and alarmingly. The US long term treasury yield (below chart using 10-year-yield as an example) has been steadily increasing since the bottom in March-2020, mainly due to the expectation of higher inflations, while the 12 month cash rate stays down.

Though technology and globalization are inherently deflationary, [compressed industrial activities + weaker USD + monetary & fiscal stimulus + strong US housing market] combined has increased the likelihood for inflation to shoot up even when people have less means to spend money.

Regardless of whether you think actual inflation would hit and sustain at a materially higher level (which could be a topic for another 5 newsletters), market expectations are definitely rising as evidenced by raising long term treasury yields (or curious readers can research on real rates). And as we know, long term interest rate rising could probably hurt your growth stock valuation. It’s precautionary to look at some protection trades.

Suggested trades

Summary:

$TLT: outright short; low cost hedge on higher inflation;

$TLT: use OTM call spread to fund OTM put spread; 8x max payoff in 6 months.

Dont miss < $LQD option trades > subscribe to make sure you see a nuanced trade idea using similar logic, with extra protection on US corperate bonds.

Trade idea details:

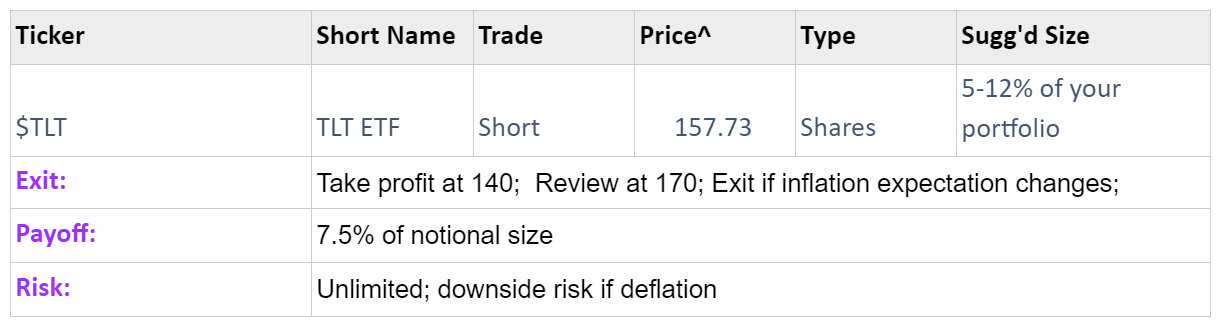

$TLT: outright short; low cost hedge on higher inflation;

We simply think an outright short on US treasury bonds isn't too bad of a trade itself, given how low the yield, therefore the carry cost is.

$TLT (iShares 20+ year bond ETF) is one of most active traded US Treasury ETFs. Its core holdings are long term treasuries with 20 years or more to maturity. With a net indicated yield of 1.25% (approx. for annual carry cost for shorting a bond), shorting this ETF makes it more of pure (cheap*) bet on the bond price move. And Shorting it means we are betting on higher longer term interest rates or closely correlated, higher inflation expectations. US 20 year treasury yield has already increased from 1% to 1.44% since Aug-2020 to Dec-2020. Another 0.5% ~ 0.8% increase over the next 6 months is not a difficult scenario with vaccines rolling out and activities recovering.

A 0.5% increase in yield with $TLT 14.5 years effective duration (the sensitivity of bond’s price to bond’s yield) suggests the short selling would make a 7% ~ 12% return if that happens.

^ close price when published, as at 03-Jan-2021 *always check with your broker for borrow cost and other fees that might be associated with short selling.

$TLT: use OTM call spread to fund OTM put spread; 8x max payoff

For more experienced readers, $TLT also has good option market liquidity. Below are some of the option structures we think might generate nicer payoff with limited downside.

First we look for options expiring 18-June-2021 to allow some time for inflation expectation to play out further. Given the relatively flat volatility curve of $TLT, we are not paying proportionally much higher for longer options.

The leg we are potentially making profits are the put spreads with strikes [148 & 135]; that is we buy put option TLT US 06/18/21 P148 Equity and sell put option TLT US 06/18/21 P135 Equity. This means if $TLT price decreases from the current level of 157 to 148, we start to make money and our profit run will stop out if the price falls below 135.

Price levels 148 & 135 are equivalent to 6.7% fall and 14.4% fall from 157; which also roughly translate into 0.43% & 0.99% increment in the 20 year treasury yield. As noted above, US 20 year treasury yield has already increased from 1% to 1.44% since Aug-2020 to Dec-2020. Another 0.43% ~ 0.99% move over the next 6 months is quite likely with vaccines rolling out and activities recovering.

We choose to sell 135 put to reduce some cost; and to be realistic: considering another 1% increase in yield, the 20 year treasury bonds could begin to look attractive to long again as a safety heaven trade, with its capital gain room increasing dramatically.

We sell the call spreads to further reduce the cost. We think given the US double deficit, inflation expectations and current momentum, it is very hard for treasury bond prices to increase sharply. Strike levels 175 and 185 are 12.8% and 17.3% out of money, and roughly translate to 0.9% and 1.2% decrease in US 20 year rates. If happens, that would basically take the entire US yield curve flat to zero (or negative in the front to belly part ). We think they are low risk funding options for our trades.

Overall our option basket has a net premium cost of $1.63. (US option market has a multiple of 100, meaning one option has 100 underlying shares). This means the minimal dollar cost of this strategy is $1.63 x 100 = $163, which requires buy or sell 1 of each option we suggested in the table below.

The max payoff is when $TLT price drops by 14.4% or more at expiry, where the $163 cost will turn into $1300 payoff (~8x); or $1137 profit, (~7x).

The max risk is when $TLT price increases by 12.85% or more at expiry, where investors will incur a total loss of $863, (~5.2x).

We suggest readers use less than 1~2% of their portfolio on the premium cost, given the highly speculative nature of this trade. Experienced readers can change strikes, expiry dates, modifying legs or increase budget of this trade to aim for more profits.

Above chart shows one’s expected payoff at options’ expiry date, vs. the $TLT share price change from current level (~$157.7).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. All the data and information used in this article is public information.

Thanks for reading and we hope you share this post with your friends. We all deserve better & cheaper investment services.