Tech megacaps are smart asset allocators

Many great investors are compared and/or want to be the next Warren Buffet. Very few discussions, however, are about which institution has shown the potential to become the next Berkshire Hathaway.

The continuous cash flows and leverage provided from the insurance arm has been one of most important factors for Buffet’s stable long term investment returns.

In the digital age, it is Amazon, rather than most money managers or financial institutions, that has been operating in a more similar way to Berkshire Hathaway, by combining stable strong cash flows + very smart asset allocation.Jeff Bezos is a mastermind in growth investing, by deeply understanding the how business models evolve over time and having the incredible patience over a very long period, both are very relatable to Warren Buffet.

While Amazon’s success in its asset allocation has been more reflected in the aggregated growth and diversities in its revenue streams, we think it is Tencent, the Chinese social network giant, quite unnoticeably, has been showing not only the genius in smart money distribution, but more importantly the wisdom in balancing between

sucking their invested companies into Tencent’s ecosystem to order to add numbers to their balance sheet

vs.

Letting their investments operate independently, giving help only when needed, and observing like an old-school value investor.

Even though there’s no sign of slowing down in Tencent’s core business, and strong innovations in its product development has been very impressive in the extremely competitive Chinese market, we think Tencent’s strategic investment team is a true gem, and its investment book really has the potential to help the company grow into the new Berkshire Hathaway in the digital era, to make Tencent a unique and once in a generation investment as at early 2021.

Investment flywheel - only by Tech

Tech companies have three major advantages over companies like Berkshire Hathaway or traditional money managers in investing post 2010, that makes us think the new Berkshire Hathaway in the digital age has to be a great tech company first.

The three advantages are:

1) Proprietary data

2) Expertise knowledge

3) (No) asset-liability issue

Data:

It is so obvious that I think almost every tech company that generates proprietary data should be in the business of investment, leveraging unique insight that could be derived.

Traditional financial institutions can only use public information supposedly, and they seek edge over competitors by looking at alternative data to create information advantage.

Tech companies, especially platforms or aggregators, are inherently built to have unfair positions to make observations on web traffics, user behaviours, order flows, app downloads and all kinds of digital & physical activities that are exclusively available to them only. This allows them not only to know who/what is currently doing well, but also where to look for the next cool thing.

This data-mismatching gap between tech investors and traditional public investors is only getting bigger and bigger: as tech companies acquire more stakes in other tech companies, the likely data-sharing will not only help the invested grow better, but in turn help the investors get better insights, and go on to make better future investment. It’s like an investment flywheel effect, with a positive feedback loop of data input -> investment decision -> investment outcome -> more investments -> more data input -> ...

This huge advantage cannot be stressed enough and is primarily why big tech companies have been and will continue to be far better investors than most other types of investors, though there’s yet to be a clear way to calculate those impressive investment returns for most of them.

Knowledge:

Great investors make non-consensus calls by understanding what most don’t. It is essentially a knowledge mismatch, no matter how that was acquired.

Tech companies, inherently from how they are built and grow, are usually equipped with far better understandings of the problems and possible technological solutions in their special field: what’s the real pain point? What’s the current engineering limitations, what techniques are truly innovative ...etc. In other words, scientists understand science better, and engineers understand engineering better, than most generalist investors.

Such “hard knowledge” advantage combined with the data advantage, can also lead to better understanding of business models and the real potential of a product.

It’s not much different to an investment bank hiring Biology PHDs to cover healthcare stocks - Tech companies just have far less financial modelers, and far more industrial experts when it comes to their investment decision making.

Similar to the data flywheel effect, there’s also a knowledge flywheel or positive feedback loop that is getting created here, in certain cases equally or more powerful as it also helps to build a talent network & brainpower that are not usually accessible to traditional investors.

(No) asset-liability issue:

Almost all money managers, if accepting external capitals, are facing the issue of matching Assets vs. Liabilities.

To meet return hurdles and liquidity requirements from the liability side, be it client flows or insurance payouts, traditional investors are usually tied up with many more constraints.

Ability to generate their own cash = having much greater flexibility. Tech companies that are investing their own excessive amount of capital can make much more concentrated bets and be a lot more patient, both of which have been proven ways to beat the market.

Tencent’s investment book:

Generating probably the humongous amount of valuable data,

Having elite level of understanding of both software engineering, and product building (contrary to Facebook’s acquisition strategy, Tencent has a reputation of building great products in-house),

And sitting on huge cash pile that’s keep adding every quarter,

Tencent couldn’t be a better example to study how it invests.

Over the period from 2014 to 2019, for every 100 dollars generated from its operating cash, Tencent has spent almost every single dollar into investment, that’s right a 100/100.

This number for Aliaba is 80/100, for Amazon it’s 63/100, for Google & Facebook it’s 54/100, for Microsoft it’s 30/100. And for Apple, it’s negative 66/100, meaning they have spent most of their cash in stock buybacks rather than investing out.

As a result, as of June-2020, a whopping 49% of Tencent’s total assets are the book value of its investments, with a split of 57% in public market and 43% in private market.

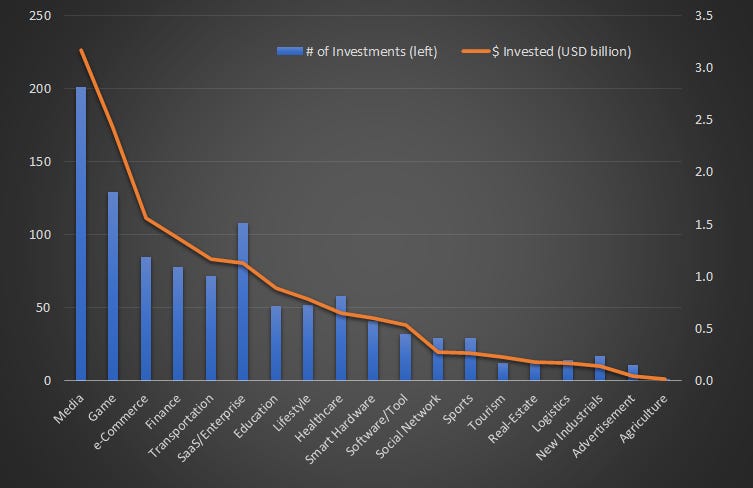

Given the nature of its core business, a lot of investments are early stage companies, and a lot of investments are in the Media and Gaming sectors. Yet we can still clearly see that:

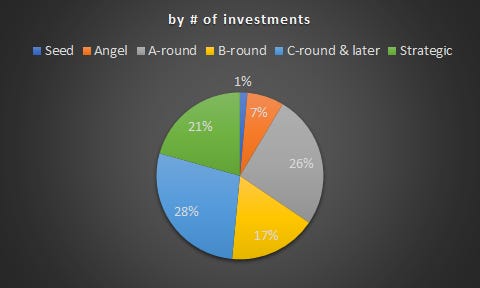

C-round & later + Strategic investments account for almost 50% of its total investment. This is due to the size issue more recently but also that Tencent’s investment style already tends to be more “financial” than “acquisitional”.

This is the balance we talked about that Tencent has and differs itself to most other Tech companies in investing. Instead of getting hands dirty into operations of the business they put money into, Tencent’s vision in its capital deploying is closer to Berkshire Hathaway: smarter allocation and let good operators run.

The overall investments, after heavy weights in Media and Gaming, are still pretty diversified. The diversification is justified by that social is such a big part of many things, but the pursuit of risk-adjusted financial success is pretty obvious here: instead of purely adding gun powers to their core revenue generators, they are building a balanced equity book. (They have disclosed no single investment’s book value is more than 5% of its total assets)

How much are those investments worth now

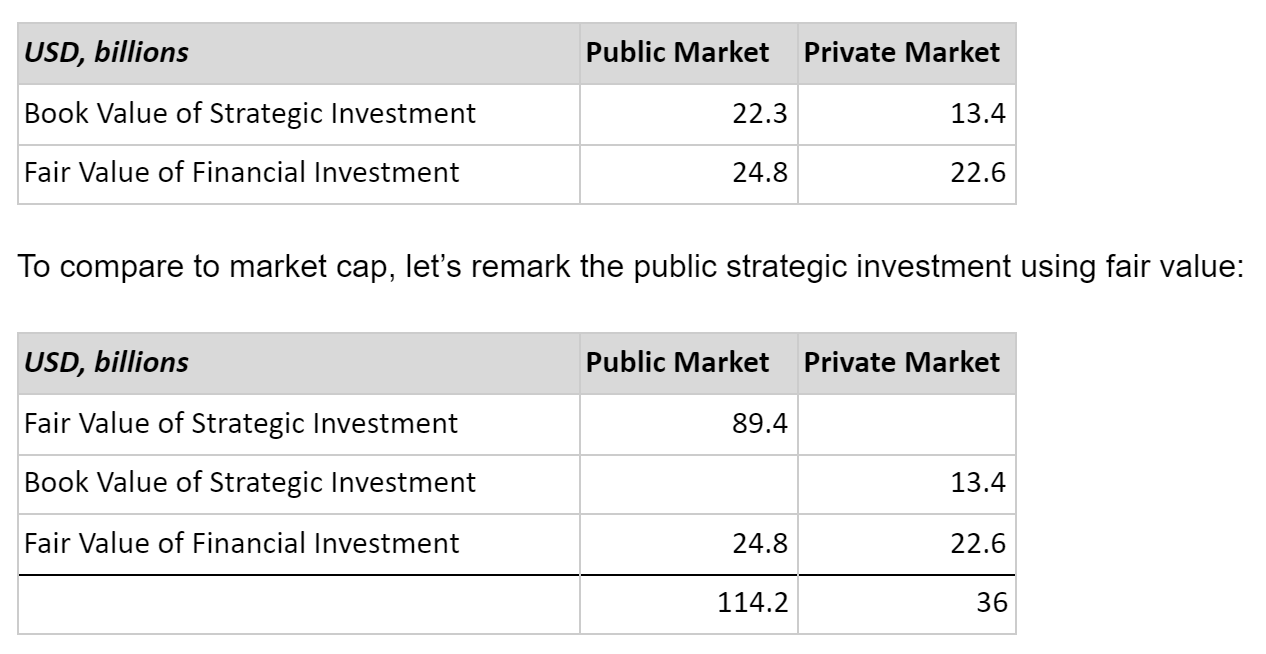

It’s rather a little complicated how Tencent presents their investments using different accounting measures. Out of their financial report as at 30-Jun-2020, I regrouped various investment related entries into below table:

So based on its June 2020 reporting, Tencent already had more than 114 billion USD invested in the public financial market. This by itself, already compares to Renaissance’s 110 billion, Bridgewater’s 150 billion, and Berkshire’s ~200 billion.

And a simple ratio of the Fair Value / Book Value indicates the total return of that part alone, is > 300% over the years. Given most investments by dollar amounts happens after 2014, a rough guess is a somewhat annualized return between 20-30%.

But it’s much more than that.

By collecting public reports, let’s take a closer look on Tencent’s biggest public holdings:

^since IPO, less than 12 month ago

These top public holdings add up to 187 billion USD as at 19-Jan-2021.

Let’s then take a bit of “wild” estimate, applying a 85/15 rule => assuming these positions accounts for 85% of Tencent’s entire public investment book => we then have 220 billion USD of its total public investment at the moment.

How significant is this?

Albeit some recency bias, from 30-Jun-2020 to 19-Jan-2021, Tencent’s public market investments alone (not including any private investment) has seen its market value increased by 108 billion, or 61% of Tencent’s total market cap appreciation over the same period.

This should convince you that buying Tencent primarily for its gaming and social growth is wrong.

Tencent, different to most social media or gaming companies, is running a very aggressive investment book, which has been growing and will continue to grow very aggressively. That investment book’s performance will be making a bigger impact to its overall operation and share price movement.

Please note we have not remarked any of its private investment book value, out of which we will see multiple unicorns going public soon.Counting its 10 most reported private holdings only, Tencent’s stake already sums up to 30 billion USD vs. 36 billion USD book value it recorded at purchase cost.

Does this make Tencent a good investment ?

Let’s take a quick look at its core business. Assuming Tencent’s private investment is still worth its original book value, the ex-Investment Market Cap is currently ~533 billion USD.

Based on consensus operating revenues and incomes, we can see its core business is probably valued at 8x P/S ratio or 23x P/E ratio

It suffices to say this is quite reasonable (ok, attractive) in this inflated market. Mind you this company still has >25% YoY revenue growth, >25% Net Income Margin, and a very very under-monetised Wechat ecosystem.

In another words, if you’re willing pay for 11x P/S or 34x P/E for its core business, you get a 250 billion USD investment portfolio, for free.

Its public investment book, while being impressive, should raise some concerns given the concentration of Asia market and extra volatility it brings to the stock price. But it is where they can utilise their data and knowledge advantages most at an early stage of becoming an investment firm, and it’s a good diversification to core DM equities.

As they expand to the global market, I believe the investing flywheel will help them keep making good calls. After all, judging by its track record, it’s simply too good to ignore. Their top public holdings made an average 293% return over the last 12 months, and best performers spread over sectors like: Electric Vehicle, FinTech, Social e-Commerce, new content creators, digital Real Estate, SaaS. Through the invested companies, they also have exposure to Battery tech, 5G, Robotics, ...etc.

It should convince you the odds to continue to find these diversified disruptive names are still on their side, evidenced by that: behind Media, Gaming & e-Commerce, the following 6 industries that Tencent invested most are: Finance, Transportation, SaaS, Education, Healthcare & Smart hardwares.

Out of the biggest 500 private unicorns in the world, Tencent holds 1/10 of those, more than most venture capitals. We believe the data and knowledge mismatching between Tencent’s investment team and most investors is huge. It is a great way for investors to get a managed active exposure to both public and private great companies.

Another upside here is there’ no key man risk, compared to most hedge funds. This is pretty much a proprietary investment playbook built on data and technology knowledge base, that could pass onto new analysts and managers, though it is a bit sad that machines are playing a much bigger role than humans even in discretionary style of investing.

Trade Suggestion:

For investors who want an active exposure to Asian technology, we believe investing in Tencent is better than most thematic ETFs you can find. Investing in Tencent has the benefit of the combination: one of the best cash machines in the world + best investment manager deploy that cash.

It is somewhat still misunderstood - the willingness of the Company wanting to become an investment firm gives us a chance to let the new Berkshire Hathaway manage the money for you.

We simply suggest a core position of long Tencent. In our model portfolio, we have recently initiated a position of 5.6%, and intend to hold for long term.